In a recent enforcement initiative, HM Revenue and Customs (HMRC) has identified 518 employers who failed to correctly pay their staff the National Minimum or National Living Wage.

These employers are now required to repay a combined total of £7.4 million to nearly 60,000 affected workers. In addition to repaying underpaid wages, they also face financial penalties of up to 200% of the shortfall.

While HMRC acknowledges that not all breaches are deliberate, the department has made it clear that non-compliance—whether intentional or not—will result in action being taken.

To support workers, the government has made tools available for individuals to verify their hourly pay. Workers are being encouraged to utilise these resources, and further support is also available from Acas.

What Do Employers Need to Know?

If you employ staff, it is vital to ensure they are paid at least the National Minimum or National Living Wage applicable to them.

This task can be more complex than it seems, as a range of factors can impact wage calculations. It is recommended to review official guidance each time a new employee is taken on. Frequent errors made by employers include:

-

Deducting wages for costs or items associated with the job.

-

Making deductions for the employer’s own use or benefit.

-

Not compensating staff for time worked beyond their scheduled shift.

-

Failing to pay for business travel time.

-

Not paying employees for training hours.

-

Missing the annual rate increase effective from 1 April.

Wage Rates for 2025/26

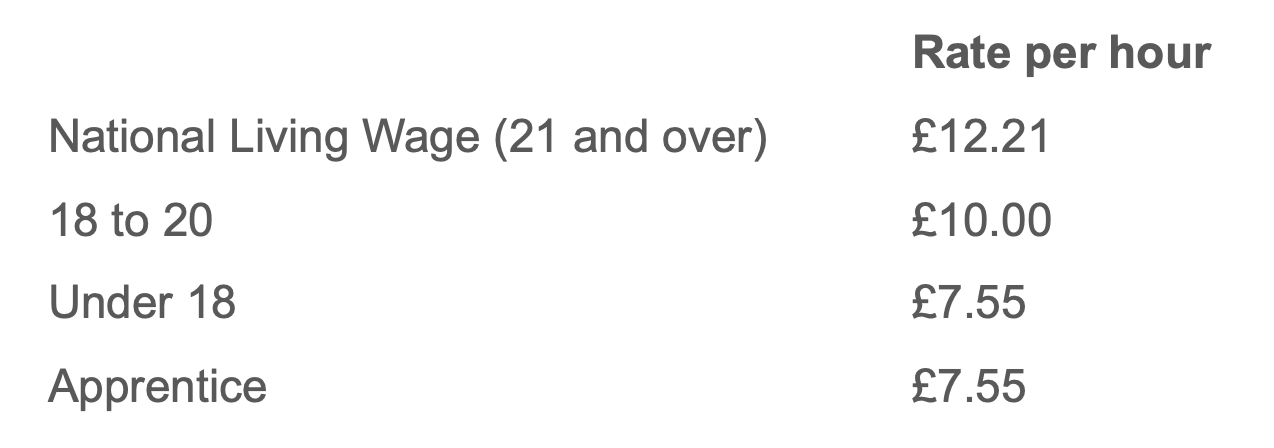

Effective from 1 April 2025, the following hourly rates apply:

If you’re unsure whether your pay practices are compliant or need guidance on how the legislation applies to your business, feel free to contact us. We are here to support you.

For further information, see the official release:

Over £7.4 million put back in working people’s pockets by employers