As well as charging interest on tax paid late, HMRC may also levy a penalty where there is an error in a tax return. These penalties may be judged as careless or deliberate and the level of penalty will also depend upon whether or not;

- the taxpayer has been upfront, making unprompted disclosures to correct the error;

- the error was deliberate; and

- the error was concealed from HMRC.

This matter is topical following the recent sacking of the former Chancellor of the Exchequer and Chairman of the Conservative Party Nadeem Zahawi who was adjudged to have been careless in connection with the reporting of capital gains and allegedly received a 30% penalty.

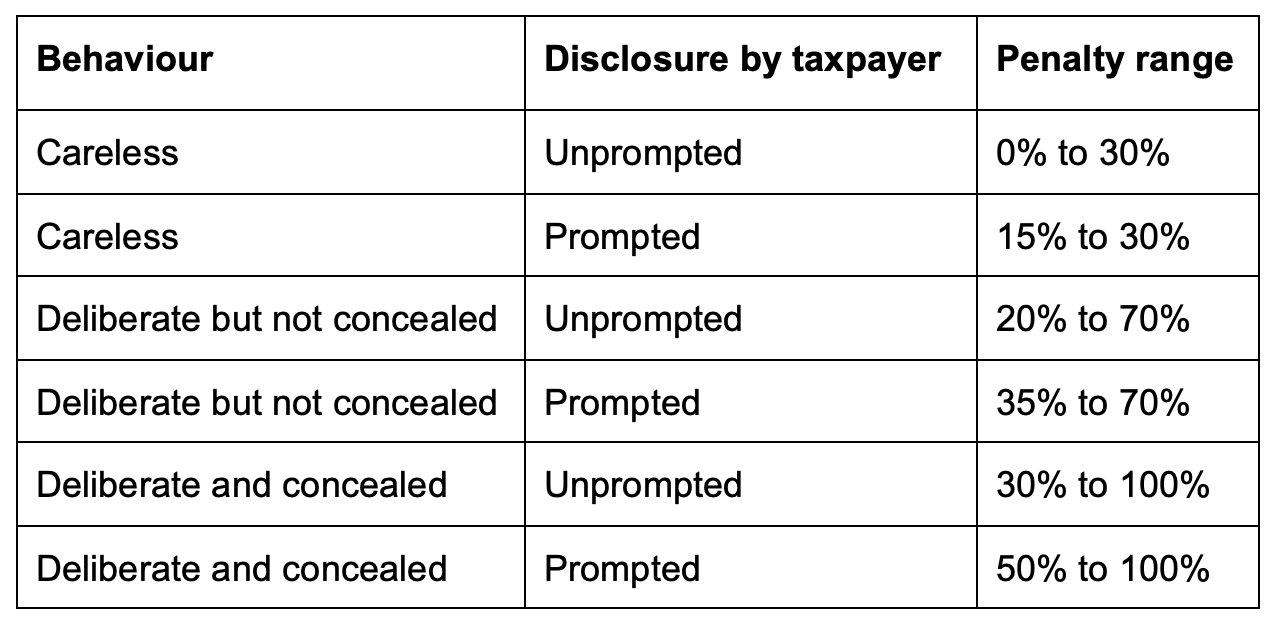

The amount of the penalty is based on the Potential Lost Revenue (PLR) and the range of penalties is set out in the table below:

Higher maximum penalties may apply when offshore matters are involved.

Where HMRC issue the taxpayer with a “nudge” letter that would be regarded as a prompt from the department and thus potentially increases the level of penalty that might be imposed.

The law defines ‘careless’ as a failure to take reasonable care and needs to have consideration of the taxpayer’s abilities and circumstances. In HMRC’s view it is reasonable to expect a person who encounters a transaction or other event with which they are not familiar to take care to find out about the correct tax treatment or to seek appropriate advice. A taxpayer who can demonstrate that they acted on professional advice from a person with the appropriate expertise, will normally be able to demonstrate they take reasonable care.

HMRC may reduce, or mitigate, the penalty depending on the quality of the disclosure, but any such reduction will not take the penalty percentage below the bottom of the stated range. The quality of disclosure is based on three factors – ‘telling’, ‘helping’, and ‘allowing access to records’.

HMRC may also suspend a penalty if it can be demonstrated that controls can and will be put in place to prevent the matter occurring again in future.