The key tax takeaways from the Scottish Budget, held on 4th December, concerned the Scottish Rate of Income Tax (SRIT) and Land & Buildings Transaction Tax (LBTT).

Scottish Rate of Income Tax

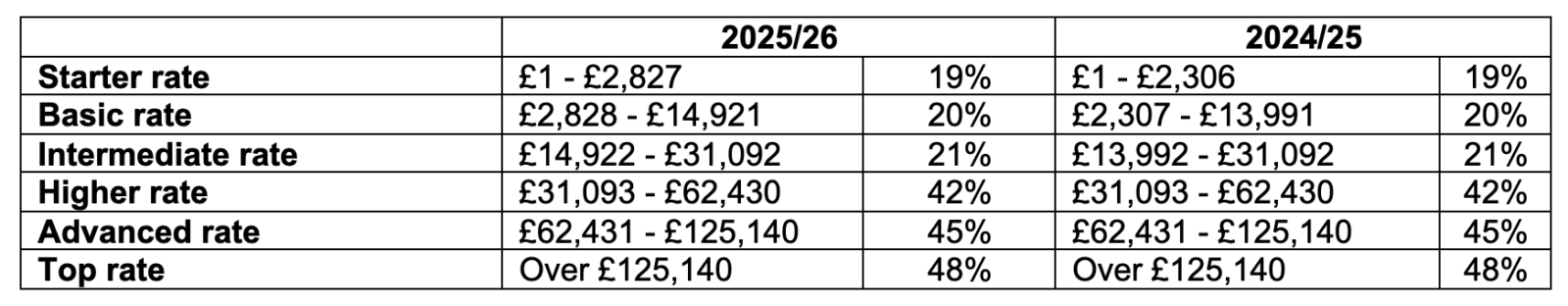

If a taxpayer’s main residence is in Scotland or they are otherwise classed as a ‘Scottish taxpayer’, their non-savings/non-dividend income is subject to the SRIT. Cabinet Secretary for Finance & Local Government, Shona Robinson, announced that the SRIT will not be increased and no new bands will be introduced for the remainder of this parliament. From 6 April 2025, the Basic and Intermediate rate thresholds will however increase by 3.5%, meaning more income of a Scottish taxpayer can be taxed at the lower 20% and 21% rates, before moving into the higher 42%+ rates.

For 2025/26, after the personal allowance has been deducted, non-savings/non-dividend income will be taxed in bands as follows:

Land & Buildings Transaction Tax

Rates and bands of residential and non-residential LBTT will remain at their current levels, although the Additional Dwelling Supplement (ADS) increased from 6% to 8% from 5 December 2024. The increase does not apply to transactions for which legal missives were signed on or before 4 December.

Wales

The Welsh Budget took place on 10th December 2024. There were no changes announced to the Welsh Rate of Income Tax (WRIT). For 2025/26 the rates and bands remain the same as those applicable in England and Northern Ireland.

Land Transaction Tax

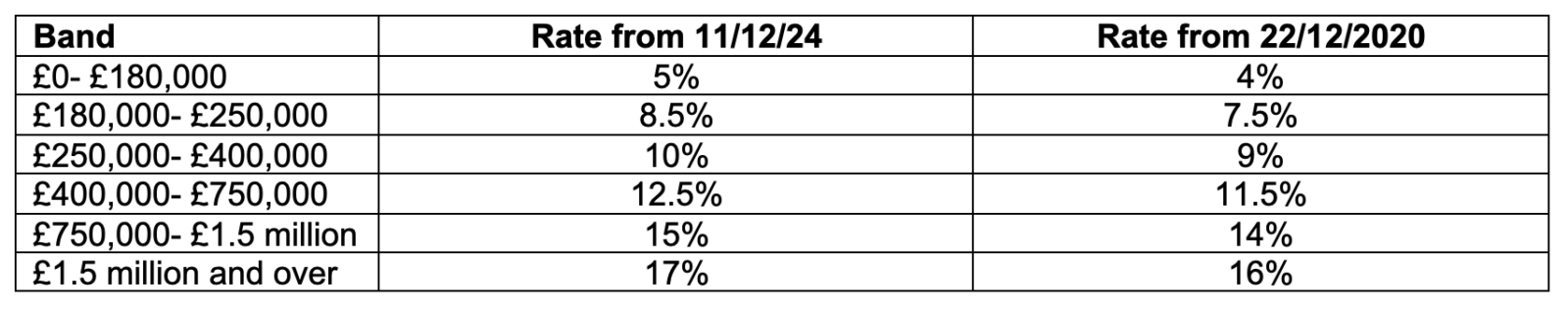

The Higher Residential Rates of Land Transaction Tax (LTT) apply to purchases of additional residential properties in Wales. These rates were increased from 11 December 2024 as follows