The spring statement and what it means for you

I AM A ‘WORKING PERSON’

The Labour government has said it remains committed to providing security, higher levels of disposable income and higher living standards to working people.

You will see on page 4 that the taxes you will pay on your income in 2025/26 remain, in the main, at 2024/25 levels. The same can be said for employees’ national insurance contributions and VAT.

If you are paid at national minimum wage rates, you will receive a pay rise from April 2025 (page 7).

However, employers in many sectors remain under increasing financial pressure, so the scope for career and pay growth may be less than previously hoped. Costs of everyday items may also increase.

I AM A BUSINESS OWNER

If you have employees, it is important to remember the significant changes coming in from 6 April 2025 to both the national minimum wage and employers’ national insurance contributions (page 7).

If you are a sole trader, make sure you are preparing for Making Tax Digital for income tax from 6 April 2026 (page 6).

And finally, make sure you talk to us if

you are starting to think about selling your business. Capital gains and inheritance tax rules (page 8) are changing, and the timing of your transaction can have a material impact on your tax liability.

I AM A LANDLORD

There are no changes to income tax and corporation tax rates on rental profits but make sure you check whether you need to prepare for Making Tax Digital for income tax from 6 April 2026 (page 6).

It is also important to keep an eye on changing stamp duty land tax rates (page 11) and the capital gains tax regime (page 8) if you are planning on buying or selling property.

MY SITUATION IS DIFFERENT…

The UK tax rules are wide-reaching and affect individuals and entities in different ways.

The above are just some simple examples. Please keep reading to see all the key Spring Statement headlines and our commentary thereon. As always, please do reach out if we can help in providing personalised advice to you.

On 26 March 2025, Chancellor Rachel Reeves presented her Spring Statement to parliament. Despite a backdrop of low economic growth and increasing government borrowing costs, the Chancellor remains committed to her ‘non-negotiable’ fiscal rules that aim to bring stability to the economy and security for working people. With further borrowing ruled out and a determination not to announce further tax changes, her focus has been on government spending.

Headlines included:

- An ongoing commitment to generate economic growth, despite short-term forecast growth levels being revised downwards from 2% to 1%.

- Confirmation of increased defence spending in a rapidly changing world.

- Changes to the welfare system, including stricter tests for personal independence payments.

- Streamlining the civil service, with an accelerated new Transformation Fund.

- Increased investment in social and affordable housing.

- Tackling skills shortages, including in the construction sector.

- A crackdown on tax evasion.

The results of a spending review will be announced on 11 June 2025. This will allocate government spending for the three years from 2026/27 to 2028/29.

The results of a spending review will be announced on 11 June 2025. This will allocate government spending for the three years from 2026/27 to 2028/29.

TAXES ON INCOME – INDIVIDUALS

Your personal allowance

Your tax-free personal allowance will remain at £12,570 in 2025/26. The personal allowance is partially withdrawn if your income is over £100,000 and then fully withdrawn if your income is over £125,140.

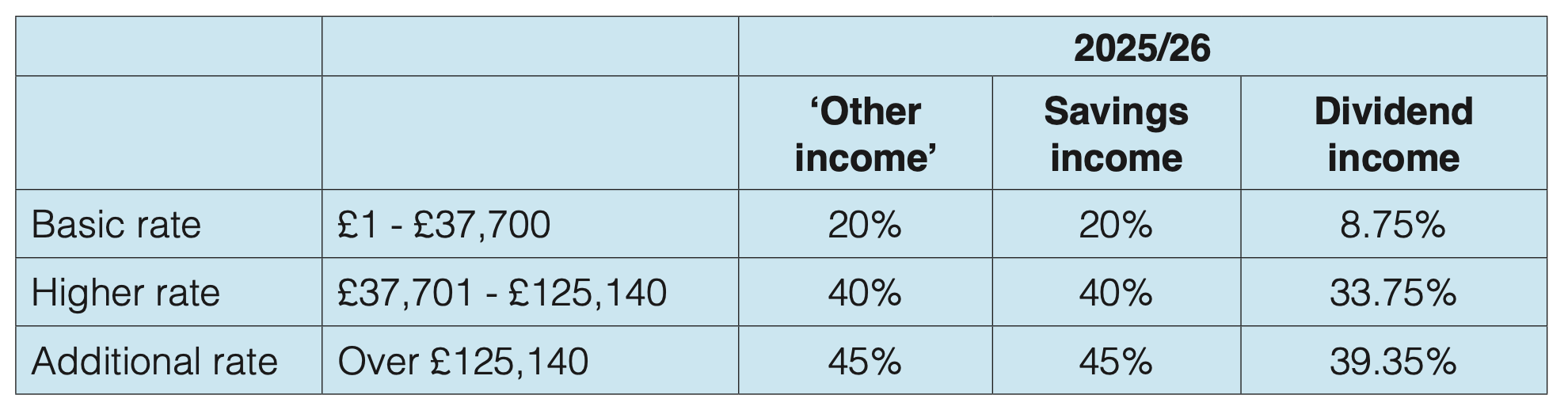

Income tax rates and allowances

For 2025/26, most income tax rates and thresholds remain at their 2024/25 levels.

After your tax-free ‘personal allowance’ has been deducted, your remaining income will be taxed in bands in 2025/26 as follows:

‘Other income’ means income other than from savings or dividends. This includes salaries, bonuses, profits made by a sole trader or a partner in a business, rental income, pension income and various other income types.

You will continue to be taxed at 0% within your personal savings allowance and dividend allowance. The savings allowance continues to be set at £1,000 for a basic rate taxpayer, £500 for a higher rate taxpayer and not offered to additional rate taxpayers. The dividend allowance continues to be set at £500.

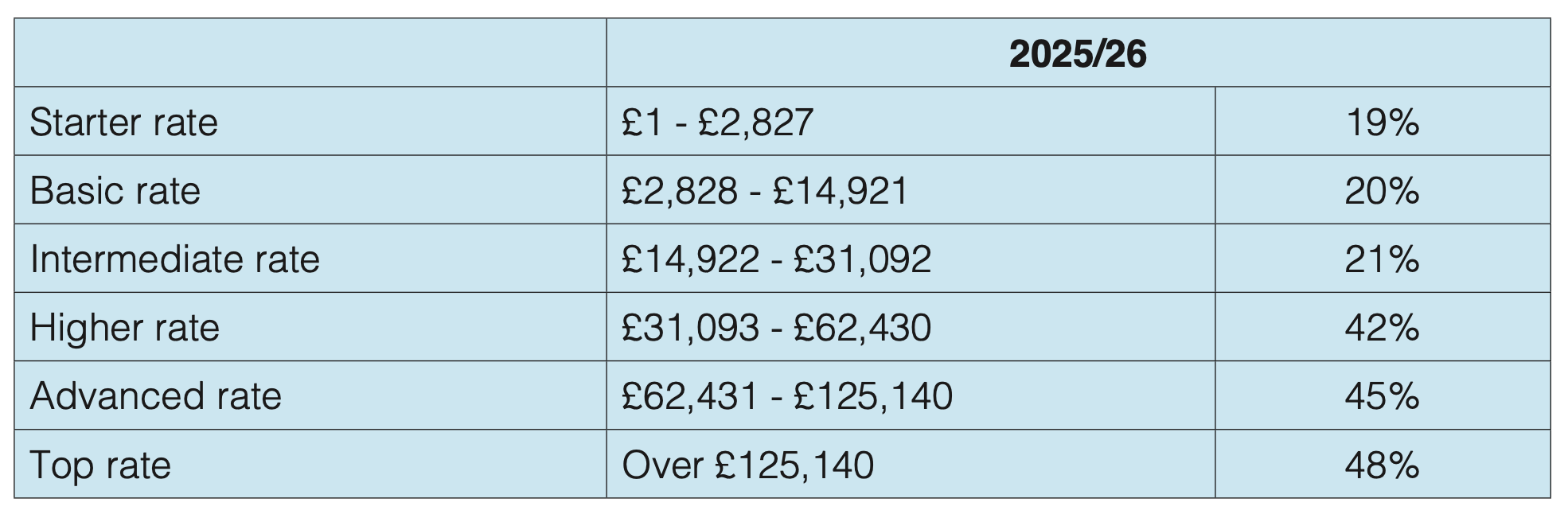

Different rates of income tax apply to your ‘other income’ if you are classed as a ‘Scottish taxpayer’. These are:

Individual Savings Accounts (ISAs)

Income received within an ISA product is exempt from income tax. This includes both cash and stocks and shares ISAs. The limit on how much you can save into ISAs in 2025/26 remains at £20,000 overall.

The government is considering how ISAs can be reformed to ensure the balance is right between cash and equities. The cash ISA investment limit may be less in future.

Tax relief for pension contributions

Income tax relief is generally given in

full for qualifying pension contributions, meaning that they are an important component in many tax planning exercises. Despite speculation in the run- up to the Spring Statement, no changes have been made to the amount of income tax relief that an individual can obtain on their qualifying pension contributions.

Residence, domicile and UK tax

The UK tax rules operate differently depending on an individual’s UK residence and domicile status. As expected, these rules will change significantly from 6 April 2025, making most UK residents liable to UK taxes on their worldwide income as

it is generated or earned, regardless of where their domicile or permanent home

is. A previous relief for non-UK domiciled individuals’ income earned and retained overseas will no longer apply. An alternative relief for an individual’s first four years of UK residence will instead be available.

Similar changes apply to the capital gains and inheritance tax regimes.

If you have any questions on your residence status for UK taxation purposes or would like to know more about how these changes affect you, please get in touch.

The High-Income Child Benefit Charge (HICBC)

You may have to pay the HICBC if your income exceeds £60,000 and child benefit is being paid in relation to a child that lives with you, regardless of whether you are a parent of that child. If you are living with another person in a marriage, civil partnership or long-term relationship, you will only be liable to the HICBC if you are the higher earner of the two of you.

For 2025/26, the HICBC is calculated at 1% of the child benefit received for every £200 of income above £60,000. This means that

child benefit is fully clawed back where income exceeds £80,000.

From summer 2025, if you are an employee who is liable to pay the HICBC, you will be able to use a new digital service to declare the charge and opt to pay it directly through PAYE, without the need to register for self- assessment.

Taxable income and self-assessment tax returns

If you are undertaking a commercial venture with a plan to make profits (e.g. buying stock to resell), tax may be due on the profits made. However, if your commercial venture is generating trading or property rental income of less than £1,000 a year, this is disregarded for tax purposes. Thisoften covers small income-generating activities such as dog walking or creating content online.

Once the £1,000 limit has been exceeded, it is necessary to report your ‘taxable activity’ to HMRC.

At present, if you have trading income

over £1,000, you are required to submit

a self-assessment tax return every tax

year. This applies even if your affairs are otherwise quite simple. The Chancellor has announced that a new simple online service will be developed in future to allow those with trading income between £1,000 and £3,000 to report their trading income and pay any tax they owe, without necessarily requiring a full self-assessment tax return. For those without tax to pay, they will not need to report their trading income at all.

If your trading income exceeds £3,000 you will remain in the self-assessment tax system.

If your trading and property rental income exceeds £50,000, make sure you read the next section, as a fundamental change to income tax reporting is coming in from April 2026!

Digital record keeping and quarterly reporting requirements for traders and landlords (“MTD”)

Updates are continuing to come through on HMRC’s ‘Making Tax Digital for Income Tax’ (‘MTD for IT’) initiative. It will initially apply from 6 April 2026 for sole traders and property landlords who generated gross trade and rental income (‘qualifying income’) of more than £50,000 in the 2024/25 tax year.

This will be followed by those with qualifying income of more than £30,000 in the 2025/26 tax year being mandated to comply from 6 April 2027.

It has now been announced that those with qualifying income over £20,000 in 2026/27 will be mandated to comply from 6 April 2028.

The MTD for IT rules are mandatory and, if affected, you will be required to use ‘MTD- compatible software’ to maintain digital records and send a quarterly summary of your business and/or property income and expenses to HMRC. This will be in addition to an end-of-year tax return. It has now been confirmed that, for those mandated into MTD for IT, the end-of-year tax return must also be submitted using MTD-compatible software. It will not be possible to use a free HMRC online service.

Other MTD for IT changes announced at the Spring Statement were:

- A limited list of types of individual who will have an exemption or deferral from MTD for IT.

- The ability for those with 31 March year ends to start complying with the MTD for IT requirements on 1 April instead of 6 April, which will remove the need for manual adjustments at the start of the tax year.There are various ways to remain compliant under the new rules, and options exist to ‘trial’ the new MTD system voluntarily before the 6 April 2026 start date. Please talk to us if you would like to know more.

MINIMUM WAGE RATES

As previously announced, the minimum hourly rates that employers must pay their employees go up from 1 April 2025. Employers must pay their employees at least these minimum rates to avoid penalties, back payments and other regulatory action.

If you have employees paid at or just above these levels, you need to ensure that birthdays, full working hours and deductions are properly captured and dealt with. Please contact us for any support with business payrolls, including the operation of minimum wage levels.

For jobs and wage rates generally, many businesses are understandably being cautious due to the current economic conditions. This includes the upcoming increases to employers’ National Insurance Contribution (NIC) requirements, covered below. For employers, having a clear forecast of expected cashflows and profits over the coming months and years is key to successful business planning. Please talk to us about how we can support you in this.

EMPLOYMENT TAXES

National Insurance Contributions (NICs)

NICs deducted from employee wages remain at the same levels as we head into 2025/26. This means that no NICs are deducted on the first £12,570 of pay, then a rate of 8% applies on earnings up to £50,270, with a rate of 2% applied thereafter.

However, significant changes will take place for the NICs paid by employers, with the previously announced increase in the rate of employers’ NICs from 13.8% to 15% going ahead from 6 April 2025. This is combined with:

- A decrease in the threshold at which an employer starts to pay NICs on each employee’s salary from £9,100 to £5,000*.* A higher threshold of £50,270 applies for employees who are under 21 and apprentices under 25. Other variations can also apply.

- An increase in the amount of the ‘employment allowance’, which eligible employers can offset against their employers’ NICs liability, from £5,000 to £10,500.

- A relaxation in the rules that determine which employers are eligible for the employment allowance. Until 5 April 2025, the employment allowance has only been available to businesses with a prior tax year employers’ NICs liability of less than £100,000. This

rule no longer applies for 2025/26, meaning employers may be able to access the £10,500 allowance, even if their 2024/25 employers’ NIC cost exceeded £100,000. Other restrictions on claiming the employment allowance still apply (including a limit of just one allowance between connected employers), so please do check with us if you are unsure whether you are able to make the claim or how to do so.

TAXES ON CAPITAL ASSETS – INDIVIDUALS

Capital Gains Tax (CGT)

As we head into 2025/26, it should be remembered that, for most sales of capital assets, CGT will apply at 18% for basic rate taxpayers and 24% otherwise. The Business Asset Disposal Relief (BADR) rate of CGT for eligible business disposals will increase from 10% to 14%, with a further uplift to 18% planned for 6 April 2026.

Particularly in relation to business disposals, timing is important, so please do talk to us about optimising your tax position prior to any capital disposal.

Inheritance Tax (IHT)

IHT can apply to certain lifetime transfers/gifts and also on the value of an individual’s estate at the time of death. The IHT nil rate band is £325,000, with an additional £175,000 ‘residence nil rate band’ available in some cases for leaving the family home to direct descendants. For any value remaining after the nil rate bands and IHT reliefs and exemptions, the maximum rate of IHT remains at 40%.

IHT reliefs for business owners and farmers

The government is continuing with its plans to reform IHT agricultural property relief (APR) and business property relief (BPR) from 6 April 2026, with a consultation process underway.

Relief of up to 100% of asset value is currently available on qualifying business and agricultural assets. From 6 April 2026, it is proposed that the 100% relief will apply on up to £1 million of combined agricultural and business property, with the relief reducing to 50% on the value that exceeds £1 million.

Another April 2026 change will reduce the BPR available on AIM shares and similar from 100% to 50%.

Care is needed when planning for these changes, as the rules are not yet certain and even gifting before 6 April 2026 will not necessarily achieve the desired effect. Please do talk to us about how best to organise your estate with business or agricultural assets.

BUSINESS TAX MATTERS

Self-employed National Insurance Contributions (NICs)

Self-employed individuals pay ‘Class 4’ NICs in addition to their income tax liability. The Class 4 NIC rates and thresholds for 2025/26 remain broadly similar to 2024/25 and, in particular, are 6% on profits between £12,570 and £50,270 and 2% on profits thereafter.

VAT

From 1 April 2025, the VAT registration and deregistration thresholds will remain at £90,000 and £88,000 respectively. There have been no changes to the rates of VAT and the standard rate continues to be set at 20%.

Electronic invoicing

The government has recently launched a consultation on the possible advantages of e-invoicing, which include productivity enhancements, cashflow acceleration and error reductions. It also considers how HMRC can support investment and encourage uptake within the business community.

Business rates

As announced at last year’s Autumn Budget, retail, hospitality and leisure (RHL) businesses will be given a 40% relief on their business rates in 2025/26. The small business tax multiplier, which applies to properties with a rateable value of less than £51,000, will also be frozen next year.

The government has consulted on longer-term measures to support RHL businesses and intends to permanently lower tax rates from 2026/27 for RHL properties with a rateable value below £500,000. The Spring Statement confirmed that an interim report on the future of the business rates system will be published in the summer. Further policy detail will follow in the autumn.

Trading with the USA and other international partners

While uncertainties around global trade and tariffs continue, the government is expressing ambitions to support digitalised trade and supply chains, bringing cross-border trade into the 21st century.

In particular, a new digital pilot with the USA to test ways to speed up trade processes for USA and UK businesses will soon commence.

CORPORATE TAXES

Rates from 1 April 2025

There is no change to corporation tax rates and thresholds for the financial year to 31 March 2026. These include a ‘main rate’ of 25% for most companies with a reduced small profits rate of 19% available to companies with profits below £50,000. The £50,000 threshold will sometimes

be shared between group or connected companies.

Research and Development (R&D) tax reliefs

With ongoing focus on the availability of R&D tax reliefs and companies’ eligibility to claim them, the government is now consulting on widening the use of ‘advance clearances’ from HMRC. This initiative intends to give companies greater certainty when planning R&D investment, while also improving the taxpayer experience and reducing error and fraud.

Voluntary advance assurances are already part of the R&D tax relief regime, but they are not commonly utilised. The consultation considers a framework where future assurances become mandatory in certain areas, namely those where HMRC are concerned about the risk of incorrect claims.

The consultation also considers whether, in future, a minimum expenditure threshold should apply to R&D reliefs, noting that a threshold of £25,000 used to apply in the past.

What is clear is that expert tax support continues to be required for all R&D activity. If this is something that you or your company are undertaking now or considering for the future, please do get in touch.

Tackling ‘phoenixism’

HMRC is expanding its efforts to tackle ‘phoenixism’ (or tax-driven business cessations followed by business start-ups), whereby company directors go insolvent to evade tax and write off debts owed to others.

HMRC, Companies House and the Insolvency Service will deliver a joint plan to tackle rogue directors who abuse the insolvency regime. The plan includes an increase in the use of securities, where HMRC asks for an upfront payment of tax from new companies. More directors will be made personally liable for the taxes of their company and there will be an increase in the number of enforcement sanctions.

Annual Tax on Enveloped Dwellings (ATED)

Companies and some other entities may need to file ATED returns or pay ATED if they hold a UK residential property with a market value of over £500,000. The rates of ATED will increase from 1 April 2025, so please contact us if you require any support with this.

STAMP DUTY LAND TAX (SDLT)

England and Northern Ireland

If you are planning to purchase residential property, remember that the SDLT thresholds will change from 1 April 2025. In particular, a 0% rate currently applies to the first £250,000 of the purchase price. It will only apply to the first £125,000 of the purchase price from 1 April 2025. The new threshold created between £125,001 and £250,000 will be subject to a rate of 2%.

For first-time buyers, the 0% rate currently applies to the first £425,000 (of properties costing up to £625,000), and this will drop to £300,000 on 1 April 2025 (for properties costing up to £500,000).

Tiered SDLT rates apply above the 0% bands, starting with the new 2% rate mentioned.

SDLT surcharges apply to purchasers of ‘additional dwellings’ (i.e. when they already own one dwelling), and to companies.

Scotland and Wales

Property purchasers in Scotland and Wales do not pay SDLT. Rather, if you buy a property in Scotland, you pay Land and Buildings Transaction Tax, and in Wales, you pay Land Transaction Tax. Both regimes have recently applied increases to the rates applicable on the purchase of ‘additional dwellings’.

PRIVATE COMPANY SHARE TRANSACTIONS

Over the last year, the government has been developing the Private Intermittent Securities and Capital Exchange System (PISCES). This is a new type of stock exchange that

will allow private companies to trade their existing shares on an intermittent basis.

Eligible investors will be the company’s employees, specified institutional investors, and individuals with high net worth or who are deemed to be ‘sophisticated’ investors. PISCES will not be open to the general public.

Legislation is expected in May 2025, with trading likely to begin later this year. PISCES will initially be overseen by the Financial Conduct Authority (FCA).

Stamp duty

HMRC is currently consulting on a Stamp Duty and Stamp Duty Reserve Tax exemption for PISCES share transactions.

Employee shares

The government has also published information on how employee-owned shares under PISCES can interact with two existing tax-advantaged share schemes:

• Enterprise Management Incentives • Company Share Option Plan

Tax relief is available for profits made by employees under these schemes if specified conditions are met.

Please speak to us if you are planning to buy or sell private company shares or offer employee ownership. We will be happy to help you navigate the legal and tax issues to find the best option for you.

DEALING WITH HMRC

Modernising HMRC

As part of the government’s ‘Plan For Change’, steps are being taken towards modernising HMRC, to improve value for money, enhance efficiencies and support economic growth. Greater innovation, including grasping technological opportunities, is at the heart of this, transforming HMRC into a ‘digital-first’ organisation. A ‘HMRC transformation roadmap’ will be published in the summer.

Improving customer service – including with AI

HMRC officials have been undertaking work to learn best practices in customer service from various successful UK brands. This includes trialling the use of generative artificial intelligence (AI) to point taxpayers to the advice they need on GOV.UK.

HMRC is also expected to roll out more widely a system where taxpayers can use their voice as their password to pass security checks faster and more securely.

New PAYE portal

In April 2025, HMRC will launch a new PAYE portal. This is intended to be a new, simple way for 34 million employees and pensioners to check the data that HMRC holds on their employment and pensions, to notify HMRC of any changes, and to find simple explanations to understand the impact of changes on their tax codes.

Tax avoidance and non-compliance

As part of a wider initiative to close the ‘tax gap’, new legislation will be introduced to further tackle tax avoidance and prevent non-compliance.

Particular focus will be applied to offshore tax non-compliance by the wealthy. HMRC are recruiting experts in private sector wealth management and deploying AI and advanced analytics to help identify hidden funds.

A consultation has also been launched on further tackling those who promote or market tax avoidance or contrived schemes. The proposals give HMRC additional powers and stronger sanctions, enabling them to disrupt the business model that promoters rely on.

Another new consultation considers whether HMRC’s powers are effective in dealing with non-compliance that is facilitated by unscrupulous tax advisers.

Tax fraud – new reporting reward scheme

A new reward scheme is being developed to encourage informants to come forward to HMRC about tax fraud. This will launch later this year and target serious non-compliance in large corporates, wealthy individuals, offshore and avoidance schemes.

HMRC compliance activity

In addition to HMRC receiving a budget to recruit and fund new compliance caseworkers and debt collection officers, we are told that the department is also investing in AI to improve the targeting of compliance work and make HMRC more productive.

Collecting taxpayer data from financial institutions

HMRC will continue working with financial institutions to improve the quality of data that

it receives about individual taxpayer transactions, for example, bank interest. Improved data will enable HMRC to modernise its services to taxpayers. This includes reducing the admin time needed in preparing a self-assessment tax return, by HMRC automatically pre-populating return areas with information they already hold. Accurate PAYE coding adjustments would be another benefit.

Penalties

Returning to the topic of MTD, the government is increasing the late payment penalties for taxpayers within the MTD regime, whether for VAT and/or income tax. Increased rates will apply from April 2025 or when the individual or business joins the MTD regime in question, if later.

The new rates will be 3% of the tax outstanding where tax is overdue by 15 days, plus 3% where tax is overdue by 30 days, plus 10% per annum where tax is overdue by 31 days or more.

HMRC is also reviewing the penalty framework that applies across the board when a taxpayer either:

• Makes a mistake in a tax return or document; or

• Omits to notify HMRC of circumstances that affect their tax liability.

It is expected that any new regime will continue to distinguish between genuine mistakes (where often a penalty is not charged at all) and conscious attempts to cheat the tax system. Overall, the emphasis is on simplifying and strengthening the penalty system.

Interest on unpaid tax liabilities

From 6 April 2025, the late payment interest rate charged by HMRC on unpaid tax liabilities will increase by 1.5 percentage points. For most taxes, this will set late payment interest at the Bank of England base rate plus 4%.

The above developments reinforce the importance of keeping your tax affairs up-to-date and adequately budgeting for future tax liabilities. Flexible ‘time to pay’ arrangements can sometimes be agreed with HMRC. We can support you with any of this.

IN CONCLUSION

The Spring Statement was an economic update given in challenging circumstances, in what was regularly referred to as a ‘changing world’. The government remains focused on securing Britain’s future and seizing opportunities.

Just as government departments turn to efficiencies and use of AI to enhance productivity, 2025 is a year for your business or household to consider the same, ensuring growth is achievable for all.

Remember, we are here to work alongside you to ensure your business and personal success. Please do get in touch if there is anything that you would like to discuss.