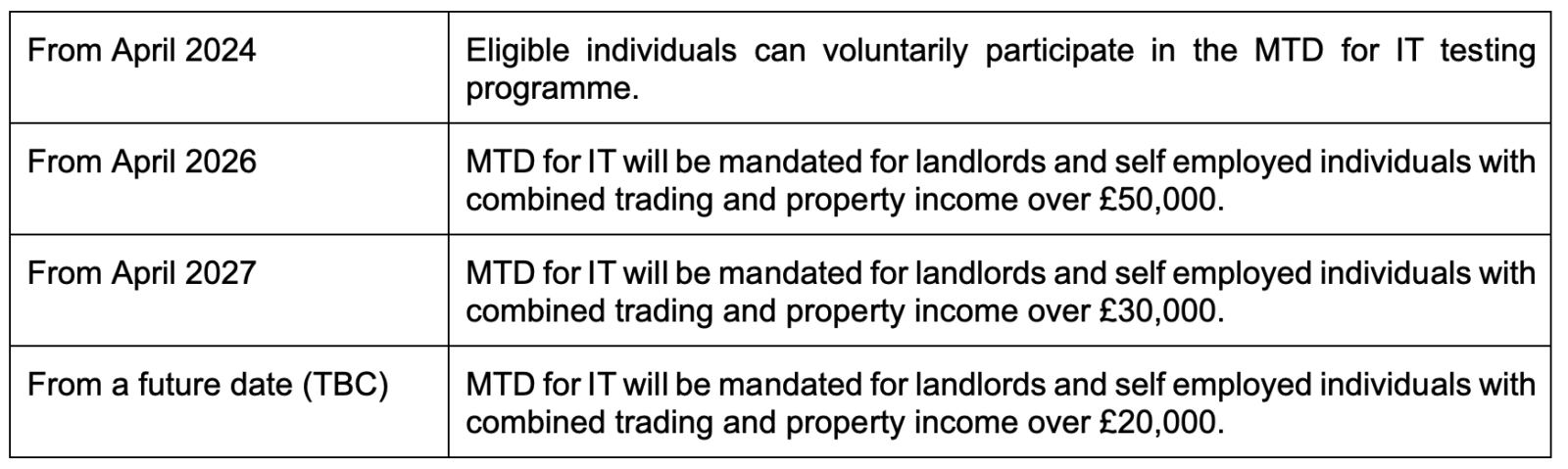

Prior to the Autumn Budget, there was hope that the new Labour Government might further delay the introduction of Making Tax Digital for Income Tax (MTD for IT). However, such hopes were dashed on Budget day, with confirmation of the previously-announced timescales and an additional announcement that individuals with income from trading or property of over £20,000 will be mandated to comply with MTD for IT requirements in future. The mandate timescales are as follows:

At present, no mandate deadlines have been set for partnerships.

Complying with the requirements of MTD for IT will involve keeping business records in specialist compatible software and then using that software to submit the business results to HMRC on a quarterly basis.

The introduction of MTD for IT is just over one year away, so now is the time to start thinking about the changes it will bring to your business, if you are self-employed (but not in a partnership) or receive rental income. We are here to help, so please talk to us to find out how MTD for IT will affect you!