After weeks of speculation about what Budget 2025 would contain, the Chancellor was unexpectedly upstaged when the Office for Budget Responsibility (OBR) accidentally published their report revealing key policy measures ahead of the official announcement.

Although the report was quickly withdrawn, the information had already been picked up by media outlets and tax commentators.

Ultimately, however, the manner in which the details were released matters less than the substance of the policies themselves. It is the impact of these measures that will be felt over the coming years.

How does Budget 2025 affect your business? Let’s take a closer look at some of the key points and consider their potential implications.

A Tax Hit for Property Owners and Savers

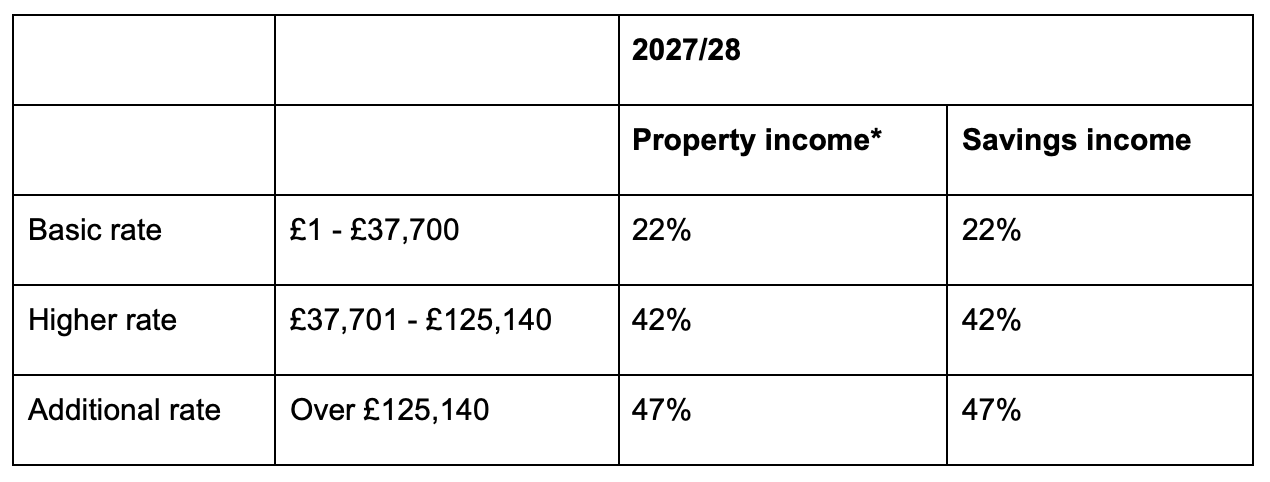

Budget 2025 announced that, from 6 April 2027, the government will create new separate income tax rates that apply to property income and will increase the rates for these and for the income tax rates on savings income by two percentage points.

The new rates will be as follows:

The new property income tax rates will apply to taxpayers in England and Northern Ireland. The Scottish and Welsh governments will have the power to set property tax rates for those jurisdictions.

Owners of property worth more than £2 million were also affected by the introduction of a high-value council tax surcharge, otherwise known as the ‘mansion tax’. The surcharge will be in addition to the existing council tax and will range from £2,500 to £7,500 depending on the property’s value. Properties will be valued before the introduction of the tax.

If you are a landlord, one or both of these changes could increase your costs. With the abolition of the furnished holiday lettings regime, higher stamp duty land tax on additional properties, the added responsibilities under the Renters Rights Act, and now the prospect of increased tax on property income, it is understandable to question whether continuing to let property remains worthwhile.

If you are concerned, please feel free to contact us. We can provide personalised advice to help you review your options, explore strategies to manage your tax exposure, and identify solutions that work for your individual circumstances.

Increase in Dividend Tax

If you are a company shareholder, from April 2026, the dividends you receive will be subject to higher rates of tax. The basic and higher rates of dividend tax will rise by 2% to 10.75% and 35.75% respectively.

For owner-managed companies, these increased rates raise an important question: do dividends remain a tax-efficient way to extract funds from the business? Those considering incorporating their business will also want to understand how these changes may influence their decisions.

We can provide tailored advice to help you plan effectively, ensuring that you continue to extract income in the most tax-efficient way possible. By reviewing your options in advance, you can make informed decisions that protect your hard-earned income and maximise the benefits of any available reliefs.

Increasing Payroll Costs

Even before the Budget speech, the new national minimum wage rates had been announced. These new rates come into force from 1 April 2026.

We’ve covered the details of the new rates separately, but it’s worth noting the 4.1% increase in the main National Living Wage rate that applies to employees aged 21 and over and the rise of between 6.0% and 8.5% for employees under 21 and apprentices.

Employees who are paid at higher than minimum wage rates may also be looking for comparable increases in their pay. These could mean a fairly substantial uplift in your payroll costs next April. It will be important to ensure that you budget for these costs and take them into account with any recruiting you have in mind over the next year.

Salary Sacrifice for Pension Contributions

If your business offers salary sacrifice for pension contributions, an important change is coming in 2029. At present, all pension contributions made through salary sacrifice are exempt from employer national insurance contributions (NIC), regardless of the amount. This provides valuable savings for both employees and employers.

From 6 April 2029, however, the NIC exemption will be capped at £2,000 per year for employee pension contributions made via salary sacrifice. Any contributions above this threshold will continue to receive income tax relief but will become subject to both employer and employee NICs.

Although this change is still a few years away, it’s worth considering now how it may affect the overall value of your employee pay and benefits packages.

IHT reliefs for business owners and farmers

The government is pressing ahead with plans to reform agricultural property relief (APR) and business property relief (BPR) from 6 April 2026. These are important inheritance tax (IHT) reliefs that currently mean that up to 100% relief is available on the full value of qualifying assets.

As announced in last year’s Budget, from April 2026, this 100% relief will be capped at a combined £1 million of agricultural and business property, with any excess qualifying only for 50% relief.

However, Budget 2025 did provide some good news. It added that, from 6 April 2026, any unused APR or BPR allowance will become transferable to a surviving spouse or civil partner. As a result, couples may be able to pass on up to £3 million of qualifying agricultural or business property free of IHT.

Careful planning is essential, though. Transitional rules mean that gifting assets before 6 April 2026 may not necessarily help the situation. Please speak with us for personalised advice on the best way to organise your estate where business or agricultural assets are involved.

Capital Allowances

For 2026/27, the annual investment allowance (AIA) means that qualifying new capital expenditure you make of up to £1 million can be relieved in full against the taxable profits of your business.

Disappointingly, Budget 2025 announced that the rate of writing down allowance applicable to qualifying capital expenditure that is classed as main rate pool will drop from 18% to 14% on 1 April 2026 for companies and 6 April 2026 for unincorporated businesses, such as sole traders and partnerships.

However, this reduction may be partially offset by a new 40% first year allowance (FYA) that will be available from 1 January 2026. Its usefulness to your business may be limited, though, as it will only really be of benefit where the AIA or other FYAs are unavailable.

If you are considering buying electric vehicles for your business, Budget 2025 confirmed that FYAs that give 100% relief for qualifying expenditure on electric vehicles and charging points will be extended to April 2027.

Business Rates

As announced in the 2024 Budget, two new lower business rates multipliers for eligible retail, hospitality and leisure (RHL) properties with a rateable value (RV) below £500,000 will come into effect from 1 April 2026.

These new multipliers will replace the 40% RHL relief available in 2025/26 and will be funded by introducing a higher multiplier for properties with an RV above £500,000.

Legislation and local authority guidance have already set out the eligibility criteria for RHL properties, but Budget 2025 has now confirmed that each of the new multipliers will be 5p lower than the standard multiplier for a property with the same RV.

Mandated Electronic Invoicing

Following a consultation on the topic, the government plans to make electronic invoicing mandatory for all VAT invoices starting in 2029. A detailed implementation road map is expected to be published next year at Budget 2026.

The possibility of introducing real-time reporting (RTR) is also being considered. This is where invoice information is automatically shared with HMRC, perhaps as soon as it is sent to a customer. However, the government has confirmed that this will not start in 2029. RTR would only be introduced once electronic invoicing is widely in use and well established.

We still have a few years before mandatory electronic invoicing takes effect, and it is always possible that details may evolve as plans develop. However, businesses will need to begin thinking about the practical implications now.

In particular, these changes may influence your choice of accounting software and the pace at which you digitise your invoicing processes. Ensuring that your systems can support structured electronic invoicing formats will make any transition far smoother and minimise disruption once the rules are finalised.

In Conclusion

While Budget 2025 included much talk about growth, tackling inflation and cutting the cost of living, everyone has been asked to contribute. Freezing many income tax rates and thresholds for a further three years and increasing taxes on savings, dividends and property income will mean many end up paying more over the coming years.

It may be necessary to re-examine your business and personal plans for 2026 and beyond to be as tax-efficient as possible. Remember, we are here to support you to ensure your business and personal success. Please do get in touch if there is anything that you would like to discuss.