Your personal allowance

Your tax-free personal allowance will remain at £12,570 in 2026/27. The personal allowance is partially withdrawn if your income is over £100,000 and then fully withdrawn if your income is over £125,140.

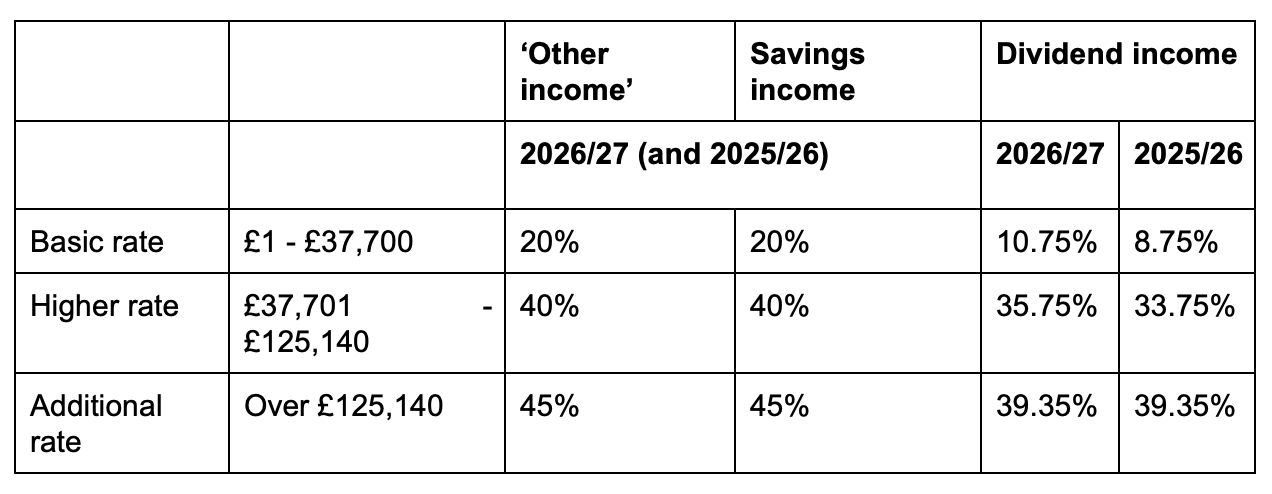

Income tax rates and allowances

For 2026/27, the income tax thresholds are unchanged from 2025/26 and are set to remain static until 2030/31. The only rates that will increase from 6 April 2026 are the basic and higher tax rates on dividend income.

After your tax-free ‘personal allowance’ has been deducted, your remaining income will be taxed in bands in 2026/27 as follows:

‘Other income’ means income other than from savings or dividends. This includes salaries, bonuses, profits made by a sole trader or a partner in a business, rental income, pension income and various other income types.

Different rates of income tax apply to your ‘other income’ if you are classed as a ‘Scottish taxpayer’. The 2026/27 rates have not been released at the time this document was created.

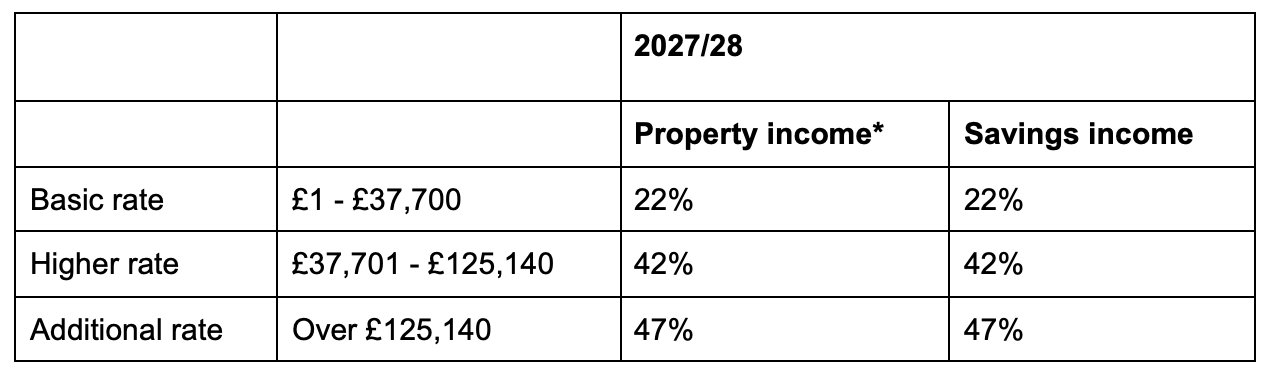

From 6 April 2027, the government will create separate income tax rates for property income and will increase the income tax rates on savings income as follows:

*The new property income tax rates will apply to taxpayers in England and Northern Ireland. The Scottish and Welsh Governments will have powers to set property tax rates in those jurisdictions.

You will continue to be taxed at 0% within your personal savings allowance and dividend allowance. The savings allowance continues to be set at £1,000 for a basic rate taxpayer, £500 for a higher rate taxpayer and not offered to additional rate taxpayers. The dividend allowance continues to be set at £500.

Self-employed National Insurance Contributions (NICs)

Self-employed individuals pay ‘Class 4’ NICs in addition to their income tax liability. The Class 4 NIC rates and thresholds for 2026/27 remain broadly similar to 2025/26 and, in particular, are 6% on profits between £12,570 and £50,270 and 2% on profits thereafter.

As with the income tax thresholds, the above Class 4 NIC thresholds will remain frozen until 2030/31.

Voluntary National Insurance Contributions (NICs)

From 6 April 2026, the Class 2 NICs rate will be increased from £3.50 to £3.65 per week and the Class 3 NICs rate will be increased from £17.75 to £18.40 per week.

The government will no longer allow people living abroad to pay voluntary Class 2 NICs. Also, the minimum time you need to have lived or paid contributions in the UK to make voluntary payments from overseas will go up from 3 years to 10 years.

Class 1 NICs for employees and employers are included in the Employment Taxes section.

Individual Savings Accounts (ISAs)

Income received within an ISA product is exempt from income tax. This includes both cash and stocks and shares ISAs. The limit on how much you can save into ISAs in 2026/27 remains at £20,000 overall.

From 6 April 2027, the annual ISA cash limit will be set at £12,000, within the overall annual ISA limit of £20,000. Savers over the age of 65 will continue to be able to save up to £20,000 in a cash ISA each year.

Tax relief for pension contributions

Income tax relief is generally given in full for qualifying pension contributions, meaning that they are an important component in many tax planning exercises.

Child Benefit and the High-Income Child Benefit Charge (HICBC)

You may have to pay the HICBC if your income exceeds £60,000 and child benefit is being paid in relation to a child that lives with you, regardless of whether you are a parent of that child. If you are living with another person in a marriage, civil partnership or long-term relationship, you will only be liable for the HICBC if you are the higher earner of the two of you.

For 2026/27, the HICBC continues to be calculated at 1% of the child benefit received for every £200 of income above £60,000. This means that child benefit is fully clawed back where income exceeds £80,000.

Qualifying Care Relief

The amount of income tax relief that foster carers and shared lives carers can claim will go up by 3.8% in April 2026. This is in line with September 2025 inflation.

Penalty reform: Updates to the penalty regime for self assessment

The government will apply a new penalty regime for late submission and late payment to all self assessment taxpayers from 6 April 2027. Under the new regime, penalties for late filing are more lenient but those for late payment are more punitive and are set to increase.

Penalties due for late payment of income tax self assessment will be increased from April 2027.

Venture Capital Trust (VCT)

From 6 April 2026, the VCT income tax relief will decrease from 30% to 20%.