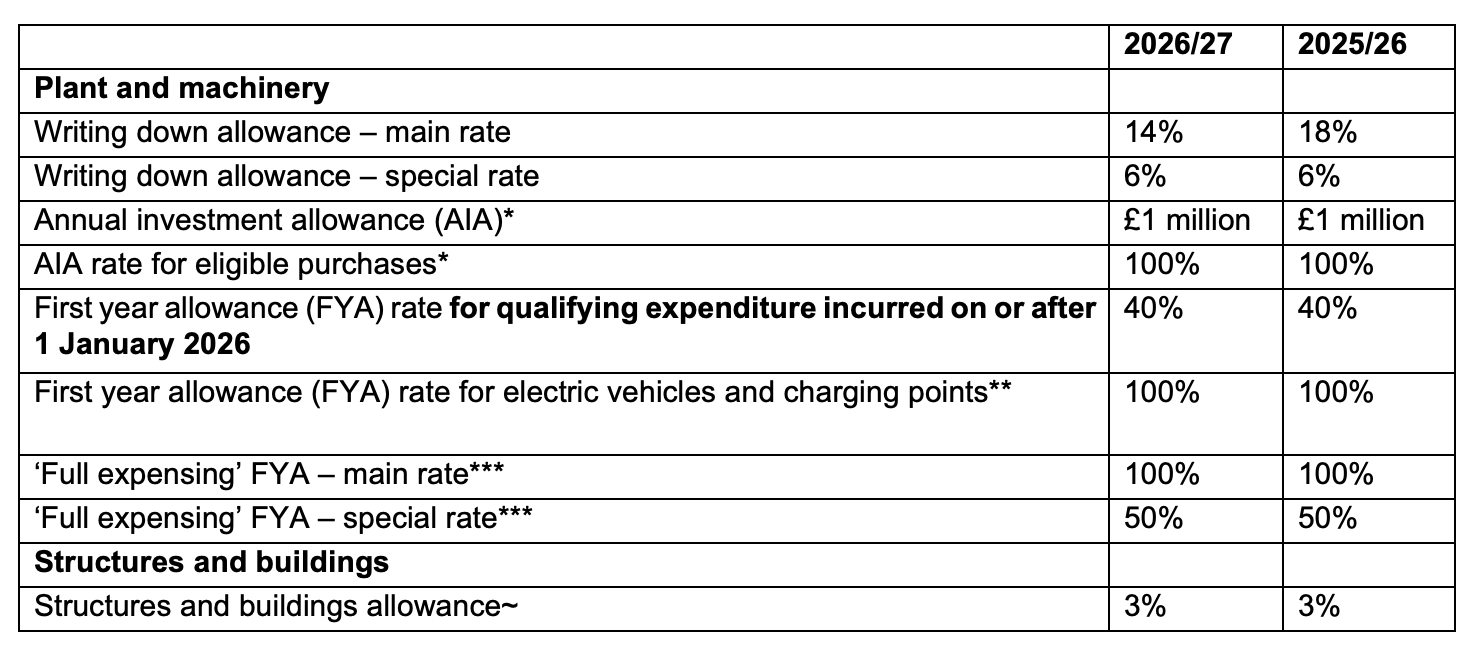

For 2026/27, the annual investment allowance (AIA) will remain at £1 million and the full expensing regime will be available to companies.

The rate of writing down allowance (WDA) applicable to qualifying capital expenditure in the main rate pool will drop from 18% to 14% on 1 April 2026 for companies and 6 April 2026 for unincorporated businesses. Businesses with an accounting period that spans the date of change must use a hybrid rate. There are no plans to alter the 6% rate of WDA for qualifying expenditure in the special rate pool.

For qualifying expenditure incurred on or after 1 January 2026, a new 40% first year allowance (FYA) will be available to companies and unincorporated businesses. The new FYA can be used against assets used for leasing (overseas leasing is excluded) but not for cars or second hand assets. It will mainly be of benefit where the AIA or other FYAs are unavailable.

FYAs giving 100% relief for qualifying expenditure on electric vehicles and charging points were due to end in April 2026 but are now extended to April 2027.

* The AIA can be used for most equipment purchased by a business, including vans and commercial vehicles but not cars. In situations where there is a corporate group and/or a person owns multiple businesses, the AIA may need to be shared between those businesses. Furthermore, some businesses, including partnerships with a corporate partner, are not entitled to the AIA at all.

** 100% FYAs are available for brand-new electric cars and electric vehicle charging points, as well as some other less common asset types. Capital allowances can be claimed on cars that are not new or electric, but at the main or special writing down allowance rates, depending on whether the car has carbon dioxide emissions of up to or more than 50g/km respectively.

*** For limited companies and a small number of other business structures, a practice of ‘full expensing’ is permitted. This is effectively an unlimited 100% FYA on almost any brand new plant and machinery acquired (excluding cars and assets used for leasing), although a lower 50% FYA is in operation for ‘special rate’ items (broadly fixtures and systems that are an integral part of a building). Full expensing is useful for companies that have no available AIA.

~ The structures and buildings allowance is only applicable for costs on construction contracts signed on or after 29 October 2018 and is more suitable for some businesses than others.