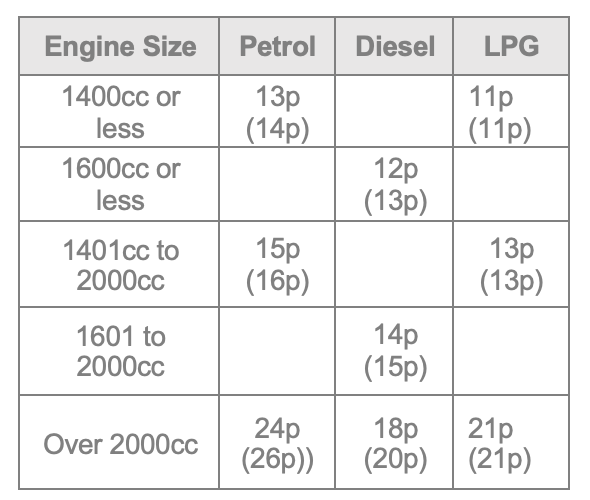

The table below sets out the HMRC advisory fuel rates from 1 September 2024. These are the suggested reimbursement rates for employees’ private mileage using their company car.

Where there has been a change the previous rate is shown in brackets. You can also continue to use the previous rates for up to 1 month from the date the new rates apply. Note that for hybrid cars you must use the petrol or diesel rate. For fully electric vehicles the rate is 7p (9p) per mile.

Where the employer does not pay for any fuel for the company car these are the amounts that can be reimbursed in respect of business journeys without the amount being taxable on the employee.

Input VAT

Within the 45p/25p payments the amounts in the above table represent the fuel element. The employer is able to reclaim 20/120 of the amount as input VAT provided the claim is supported by a VAT invoice from the filling station. For a 2000cc diesel-engine car, 3 pence per mile can be reclaimed as input VAT (18p x 1/6)

Employees using their own cars

For employees using their own cars for business purposes the Advisory Mileage Allowance Payment (AMAP) tax-free reimbursement rate continues to be 45 pence per mile (plus 5p per passenger) for the first 10,000 business miles, reducing to 25 pence a mile thereafter. Note that for National Insurance contribution purposes the employer can continue to reimburse at the 45p rate as the 10,000 threshold does not apply.